Every year, companies must prepare statutory accounts for their members and must also file a version of these with Companies House. However, dependent upon the type and size of the company, different limited company accounts…

Filing company accounts: your questions answered

Covering issues such as: the consequences of filing your accounts late; how to extend your filing deadline; when you can change an accounting reference date; whether you need to file accounts if your company is dormant, and…

(Another) Inform Direct Product Update – May 2025

This update sees the introduction of a much requested feature. You can now speedily produce prepopulated board minutes to approve company accounts, even when those accounts have not been created or filed using Inform Direct. Our…

Do my company accounts need to be audited?

Most small, standalone (non-group) private companies are not required to complete a statutory audit of their financial statements. Indeed, a research paper published in January 2017 by the Department for Business, Energy and…

How to calculate company size for year end accounts preparation

The Companies Act 2006 may allow you to prepare and file a simpler set of year end accounts, dependent upon your company’s size. But how do you determine what size your company is for the purposes of accounts preparation?…

Micro-entity accounts: your questions answered

A micro-entity is a very small company or LLP. We will define the criteria for micro-entity status below. Micro-entities may be able to produce a much simpler set of year end accounts for their members and provide less…

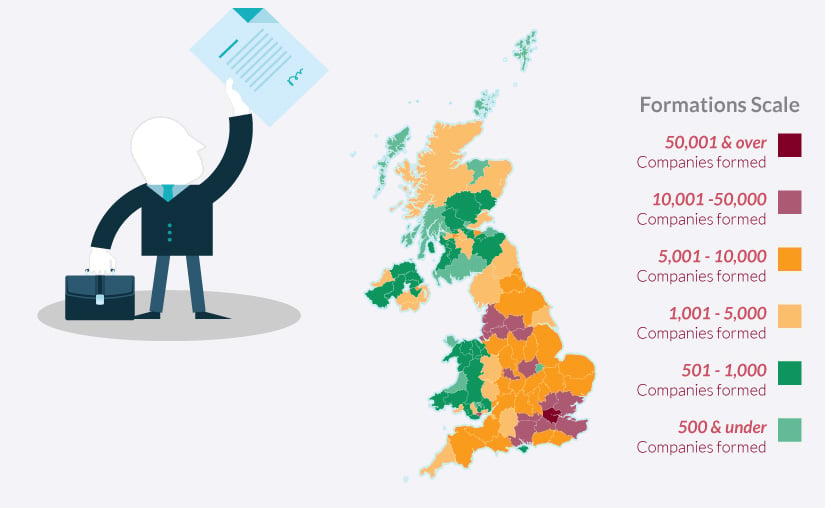

2025 Review

of UK Company Formations

Read our comprehensive review of UK company formations in 2024, year-on-year growth rates and breakdown by county. This detailed insight is provided in the form of easy to understand infographics available for sharing through social media and on your own website